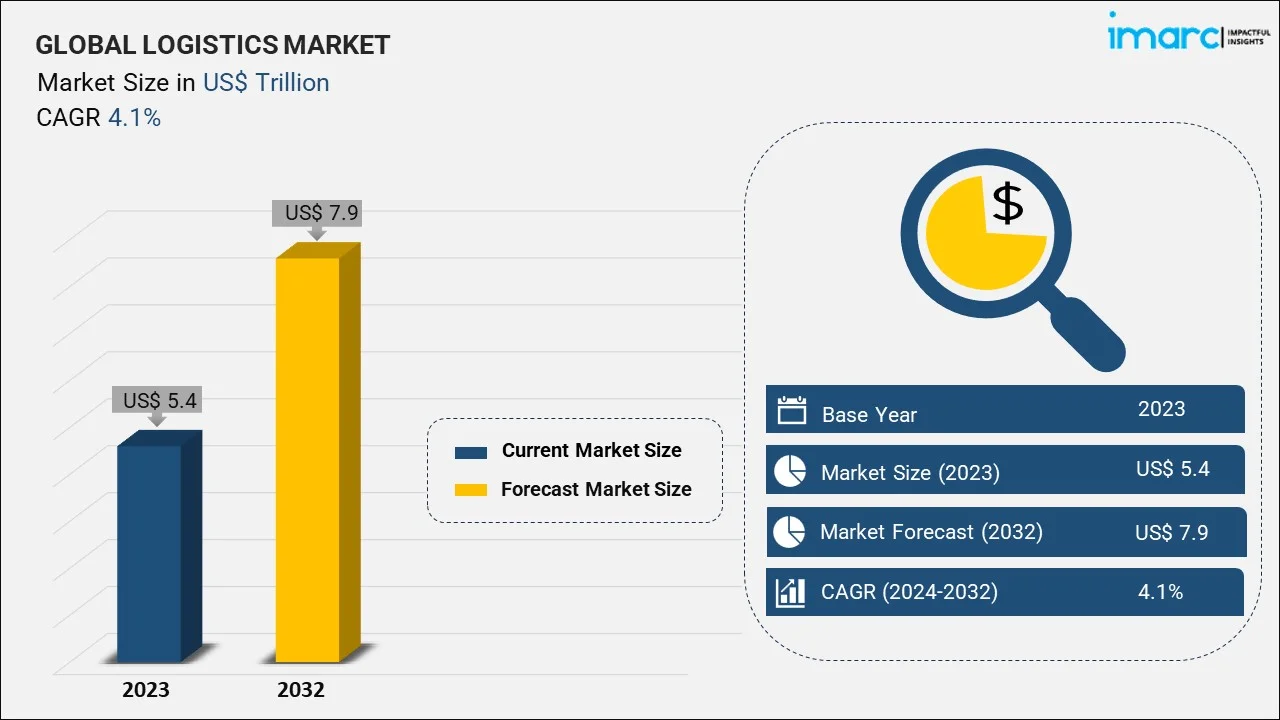

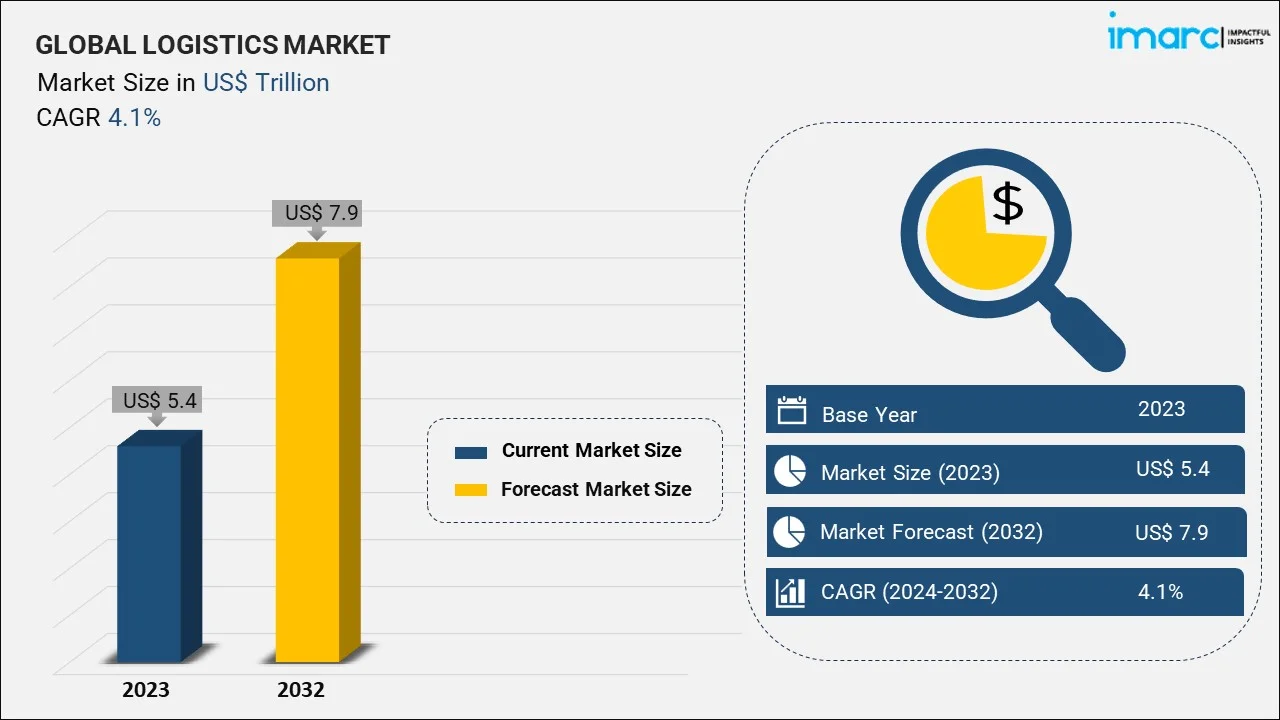

The global logistics market size was estimated to be USD 5.4 Trillion in 2023. Looking forward, the market is expected to expand from USD 5.7 Trillion in 2024 to USD 7.9 Trillion by 2032, with a growth rate (CAGR) of 4.1% over the forecast period. The market is experiencing robust growth, driven by rapid expansion of e-commerce sector, rising technological advancements, such as the Internet of Things (IoT), ongoing globalization of trade, increasing focus on environmental sustainability, and growing consumer demand for faster delivery systems.

Expansion of the E-commerce Sector

The rising expansion of the e-commerce sector, leading to a surge in demand for more diverse and faster shipping options, is providing a thrust to the logistics industry business growth. In line with this, the sudden shift towards online commerce, compelling logistics companies to enhance their distribution networks and integrate advanced technologies for real-time tracking and efficient handling of goods, is fostering market growth. For instance, logistics industry statistics state that sales in online stores reached around 22% of global retail sales in 2023, compared to 14.1% in 2019. Moreover, logistics companies are focusing on developing more responsive and flexible supply chains, capable of adapting to the fluctuating demands of e-commerce. Consequently, it is expected that by 2024, digital wallets will account for over half of total e-commerce payment volumes.

Rapid Technological Advancements

The ongoing technological advancements, such as the integration of the Internet of Things (IoT) to enhance supply chain visibility and control are acting as prominent logistics industry trends. Moreover, the growing utilization of sensors and radio frequency identification (RFID) tags to facilitate real-time data on the location and condition of goods, allowing more effective tracking and inventory management, is creating a positive outlook for the overall market. In addition to this, the introduction of QuickCommerce, an e-commerce model focused on ultra-fast deliveries within an hour, is also gaining traction across the world. In the USA, key players like Gopuff, Instacart, and Getir are heavily investing in this trend, with projections indicating revenues reaching USD 30.8 Billion in 2024. Besides this, the escalating adoption of cloud-based solutions by enterprises on account of its various advantages such as speed, cost-effectiveness, control, scalability, and security is also contributing to the market growth. A logistics industry report indicates that in the next five years, a staggering 86% of supply chain-based companies will integrate cloud computing into their operations, highlighting the growing recognition of the value of cloud-based solutions.

Rising Globalization of Trade

The elevating levels of globalization of trade among companies are compelling logistics providers to navigate a complex web of customs regulations and trade agreements, which is acting as another significant growth-inducing factor for the market. In line with this, government authorities across the world are launching favorable policies to support the growth of international trade. For instance, the UK government teamed up with Amazon Marketplace, where international customers can discover a wide range of items from small UK businesses and artisans as well as iconic British brands. Besides this, the escalating need for advanced logistics solutions and expertise in international logistics management is boosting the market growth. Additionally, the volatility in international markets, such as fluctuations in fuel prices, trade wars, and currency exchange rates, are augmenting the need for flexible and resilient supply chain solutions that can adapt to changing global scenarios.

Growing Concerns over Environmental Sustainability

The rising environmental concerns and the implementation of stringent regulations regarding reducing carbon emissions are prompting logistics providers to adopt sustainable practices, which is offering significant growth opportunities to the overall market. Currently, the transport and logistics sector contribute around 24% to global carbon dioxide emissions. Consequently, various logistic companies are increasingly investing in alternative fuels and electric vehicles (EVs) to reduce greenhouse gas emissions are favoring the market growth. Along with this, companies are also exploring innovative packaging solutions that are sustainable and cost-effective. For instance, DHL, a global leader in logistics, has recently launched GoGreen Plus, a dedicated solution to help businesses reduce the carbon emissions associated with their shipments through the use of Sustainable Aviation Fuel.

Increasing Consumer Demand for Faster Delivery

The rising consumer preference for rapid delivery systems is further catalyzing the market growth. Logistics companies are experimenting with micro-fulfillment centers, which are smaller warehouses located closer to consumers, significantly reducing delivery times. Additionally, collaborations and partnerships between logistics providers and local retailers along with the use of advanced software for route optimization are also contributing to the market growth. Moreover, the introduction of QuickCommerce, an e-commerce model focused on ultra-fast deliveries within an hour, is also gaining traction across the world. Additionally, rapid innovations, such as the adoption of aerial drones or underground delivery networks to bypass traffic congestion are fueling the market growth.

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2024-2032. Our report has categorized the market based on model type, transportation mode, and end use.

Breakup by Model Type:

3 PL Accounts for The Majority of The Market Share

The logistic industry report has provided a detailed breakup and analysis based on the model type. This includes 2 PL, 3 PL, and 4 PL. According to the report, 3 PL represented the largest segment.

Third-party logistics (3PL) holds the largest market share as it involves outsourcing logistics operations to third-party businesses, allowing them to handle a variety of services, including transportation, warehousing, cross-docking, inventory management, packaging, and freight forwarding. It has the ability to provide cost-effective, scalable, and efficient logistics solutions, enabling client businesses to focus on their core competencies. Moreover, the logistics industry top companies are forming partnerships to optimize parcel spend and streamline business operations. For instance, RateLinx and Reveel recently announced a strategic partnership to enable businesses to optimize their parcel spend management while simultaneously achieving performance gains in their freight and logistics operations.

Breakup by Transportation Mode:

Roadways Holds the Largest Share in The Industry

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes roadways, seaways, railways, and airways. According to the report, roadways accounted for the largest market share.

Roadways hold the largest in the market, due to their extensive network, flexibility, and cost-effectiveness for short to medium-distance transport. It is crucial for last-mile deliveries and for transporting goods within continents or regions where road infrastructure is well-developed. Furthermore, various grocers are partnering with quick-commerce firms like Glovo, Getir, and Rappi to enable same-day delivery via roadways. Moreover, the government authorities of several nations are making significant investments in improving road infrastructures. Additionally, according to data from the Ministry of Road Transport and Highways, road transportation accounts for around 60% of the total freight movement in India, making it the dominant mode of logistics transportation in the country, outpacing rail, sea, and air freight combined.

Breakup by End Use:

Manufacturing Represents the Leading Market Segment

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others. According to the report, manufacturing represented the largest segment.

The manufacturing industry holds the largest share of the market, as it heavily relies on efficient logistics for the procurement of raw materials and distribution of finished products. The gross value added by the manufacturing sector registered a growth of 8.71% YoY in 2022.

The manufacturing sector encompasses a wide range of industries, such as electronics and machinery, requiring specialized logistics solutions for managing supply chain disruptions, maintaining inventory levels, and ensuring timely delivery to prevent production delays

Breakup by Region:

Asia Pacific Leads the Market, Accounting for the Largest Logistics Market Share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Latin America, and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

The Asia Pacific region holds the largest market, fueled by the increasing industrialization, rapid urbanization, and an expanding e-commerce sector. This region holds nine of the world's busiest container ports and accounts for more than 40% of global surface freight transport. By 2050, freight transport demand in the region is projected to triple. Additionally, the presence of leading logistic companies in the region, coupled with the increasing focus on sustainability and efficient logistics practices is strengthening the market growth. Moreover, the imposition of supportive policies by regional governments promoting eco-friendly logistics practices is positively influencing the market growth.

The leading players are actively engaging in strategic expansions, technological advancements, and collaborations to enhance their market presence and operational efficiency. Moreover, some companies are extensively investing in digital transformation initiatives, to incorporate technologies like artificial intelligence (AI), the Internet of Things (IoT), and blockchain to enhance supply chain visibility, forecasting accuracy, and overall efficiency. Besides this, they are focusing on sustainability, adopting green logistics practices, such as using electric vehicles (EVs) and optimizing routes for reduced carbon emissions. For instance, Evify, one of the relatively new startups in India, is looking to stand out with its strategy to focus on logistics in non-metro cities. Evify has essentially set up a facility where riders can come to their hub, pick up an EV to start deliveries and return the vehicle at the end of the day.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

As per the IMARC Group, the logistics market accounted for a value of US$ 5.4 Trillion in the year 2023. Several key factors that are currently driving the global logistics market include the expanding e-commerce industry, the rising consumer inclination towards online purchase of goods, the increasing integration of numerous technologically advanced logistics platforms, etc. In addition to this, the elevating number of trade agreements among various nations that results in higher import and export activities is also augmenting the market growth.

2. What is the future of logistics industry?The global logistics market is expected to reach US$ 7.9 Trillion by the year 2032. The growing e-commerce segment, the increasing availability of high-speed network connectivity, and the shifting consumer preference towards online purchasing, owing to convenient home delivery services and attractive offers, will continue to drive the global logistics market in the coming years. Moreover, a rise observed in the trend of multimodal transportation will also lead to a steady growth in the logistics market worldwide.

3. What are the major trends in logistics?Some of the major trends in the global logistics market include the increasing internet penetration and the ongoing development of logistics monitoring systems integrated with several advanced technologies, such as blockchain, artificial intelligence (AI), augmented reality (AR), and the Internet of Things (IoT) that can track real-time information and provide predictive alerts of transportation, warehouse management, and delivery of the products.

4. What has been the impact of COVID-19 on the global logistics market?The sudden outbreak of the COVID-19 pandemic has led to the growing demand for logistics facilities to cater to the surging demand for numerous essential goods and healthcare products during the lockdown scenario across several nations.

5. What is the breakup of the global logistics market based on the model type?Based on the model type, the global logistics market can be segmented into 2 PL, 3 PL, and 4 PL. Currently, 3 PL holds the majority of the total market share.

6. What is the breakup of the global logistics market based on the transportation mode?Based on the transportation mode, the global logistics market has been divided into roadways, seaways, railways, and airways. Among these, roadways currently exhibit a clear dominance in the market.

7. What is the breakup of the global logistics market based on the end use?Based on the end use, the global logistics market can be categorized into manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others. Currently, the manufacturing sector accounts for the largest logistics market share.

8. What are the key regions in the global logistics market?On a regional level, the market has been classified into Asia Pacific, Europe, North America, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

9. Who is the largest logistics company?Logistics companies allow careful management and coordination of many people, technology, and transportation facilities so that customers can receive their goods in optimum condition. Some of the key players in the logistics market include J.B. Hunt Transport Services, C.H. Robinson Worldwide, Inc., Ceva Holdings LLC, FedEx Corp., United Parcel Service, Inc., Expeditors International of Washington Inc., XPO Logistics Inc., Kenco Group, Deutsche Post DHL Group, Americold Logistics, LLC., and DSV Air & Sea Inc.

10. Is logistics a growing industry?The logistics market is expected to grow at a CAGR of 4.1% during 2024-2032. The changing consumer inclination from conventional brick-and-mortar channels towards online-based platforms for purchasing household items, apparel, electronics, etc., will continue to drive the demand for logistic services in the coming years. Apart from this, the rising fleet connectivity, continuous infrastructural development, and ongoing advancements in the logistics management services, are expected to positively influence the global market in the forecast period.